A Review of Pando

Decentralized finance has been pivotal in the history of finance. It rose to prominence in the summer of 2020, when high-yield farming became popular. This innovation grew from a $700 million industry in December 2019 to a $200 billion industry at the beginning of 2022.

This year has seen significant traction in the DeFi sector despite a general downturn in cryptocurrency prices. However, DeFi, or open finance, remains the shining light in the industry. The total value locked within decentralized financial (DeFi) applications first surpassed $1 billion in mid-February 2020. It wouldn't even take a year for the DeFi summer of 2020 to fuel a 20-fold increase to $20 billion, and another 10 months for a $200 billion increase. It doesn't seem improbable that the DeFi markets will reach a trillion dollars in another year or two given the rate of expansion so far.

DeFi has attracted millions of users, financial institutions, and exchanges as the yields far outweigh those in traditional finance. As a monetary system built on open, permissionless, and immutable blockchains like Ethereum and Bitcoin, the DeFi ecosystem allows users to perform decentralized financial services and broaden financial inclusion.

DeFi does away with the service charges that banks and other financial institutions impose. Anyone with an internet connection can use DeFi, and users can store money in a safe digital wallet and transfer money quickly.

In DeFi, peer-to-peer lending can satisfy a person's need for a loan. An algorithm would connect peers who agree with the lender's terms, and a loan would then be granted. Through a decentralized application, or dApp, P2P payments are made and proceed in the same way as blockchain transactions.

Enter Pando, an open-source network of DeFi apps that utilizes decentralized technology to create a suite of products.

Pando: An Ecosystem Of DeFi Products

What DeFi offers is accessibility and a low barrier of entry for anyone anywhere in the world to perform traditional financial activities without the need for a centralized authority. Transactions can occur in real-time without geographical restrictions.

Pando is a one-stop shop for all the benefits that DeFi offers. It is a platform that allows users access to easy-to-use DeFi services built with the Mixin Trusted Group (MTG) technology.

The ecosystem of Pando is a congregation of DeFi products that are made for the ordinary user. Each product in the ecosystem performs a traditional financial activity using the Mixin blockchain network.

Pando, Financial Activities, And Its Suite Of Products

Traditional institutions have an array of services they offer their customers. This ranges from loans to yields on deposited money. Pando offers a similar range of services but with DeFi's efficiency. Different products in the Pando ecosystem perform different functions for the DeFi user. Here are some products and what they do:

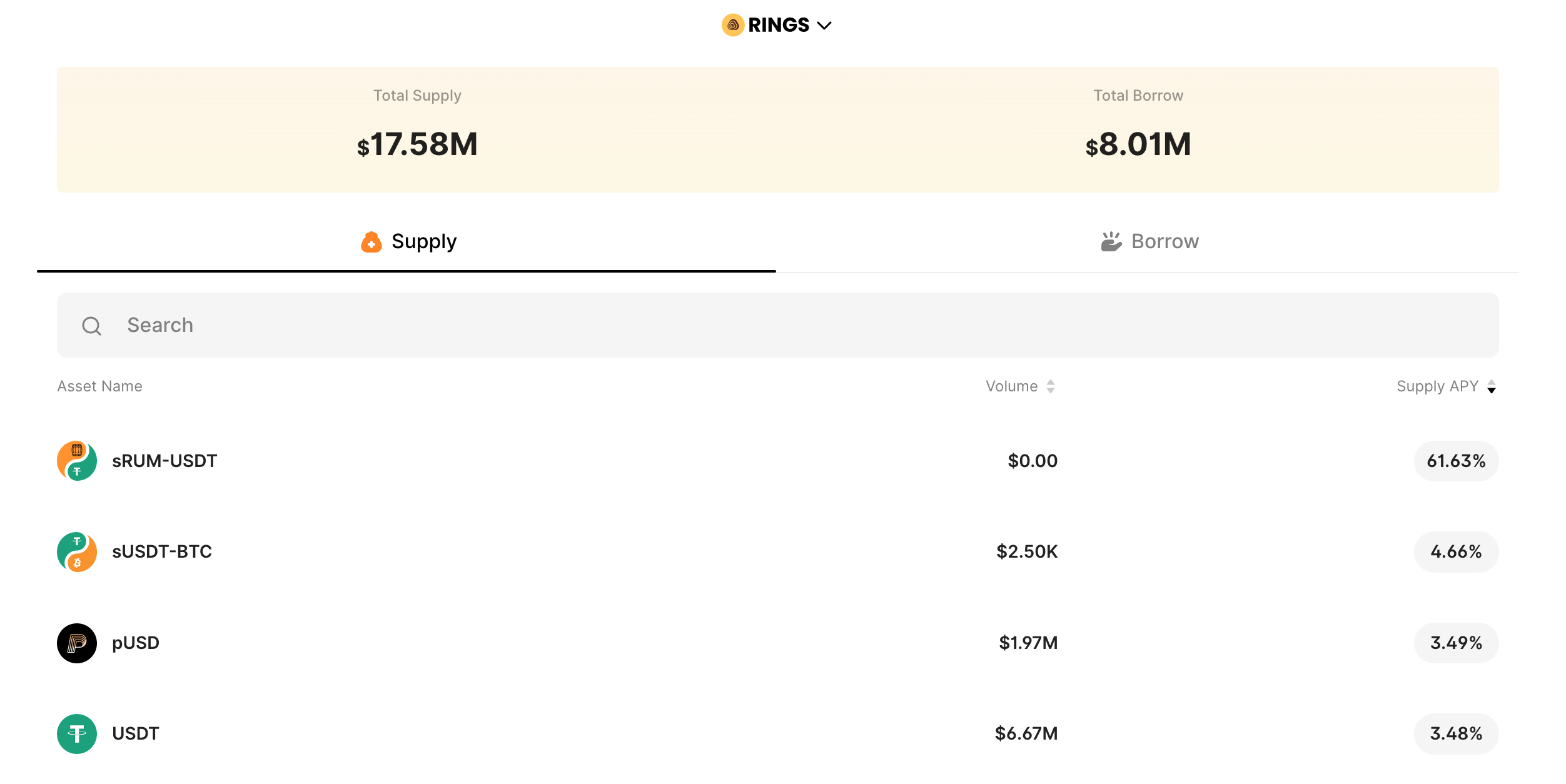

1. Pando Rings: High yields are among the features of decentralized finance that appeal most to investors. In DeFi, all transactions are peer-to-peer, and there are no middlemen involved. The lender can take practically all of the yield because all intermediate processes are eliminated.

Let's use a bank as an example to illustrate this point. If consumers are lucky, a savings account with a bank will yield 0.5% annually. Even if the bank made 10% on the money it lent clients, the user won't receive much of that money after the bank pays its expenses and takes its cut.

Pando Rings provide a higher yield framework for investors. The average annual percentage yield (APY) on savings accounts is 0.16% APY, according to data on Bankrate. Pando Rings gives a return that’s significantly higher. It's an open market where investors can lend and borrow cryptocurrencies. It operates based on an autonomous interest rate protocol built on Mixin technology. With this product, users can lend or borrow other cryptocurrencies using cryptocurrencies as collateral.

Users can earn high interest on their deposits from the comfort of their mobile phones. With the intuitive and easy-to-operate Mixin wallet, lending, borrowing, and withdrawing can be done 24 hours a day with no stress. Interest is compounded and calculated in 15 seconds, and investors can easily withdraw their principal and interest.

2. Pando Lake and 4swap:

When users (also referred to as "liquidity providers") deposit their digital assets into a smart contract, liquidity pools are created. Then, on a DEX, these assets can be traded against one another.

Liquidity pools' main objective is to make P2P trading on DEXs more accessible. The algorithm ensures that deals can be completed promptly and effectively by offering a consistent supply of buyers and sellers.

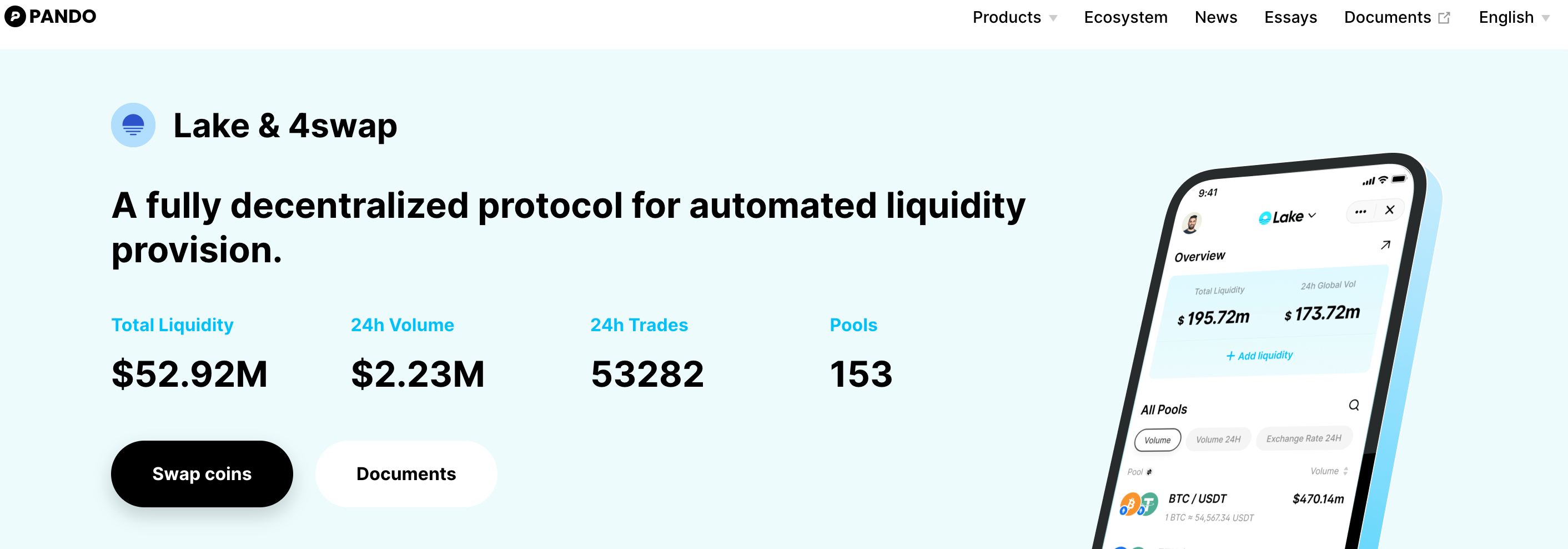

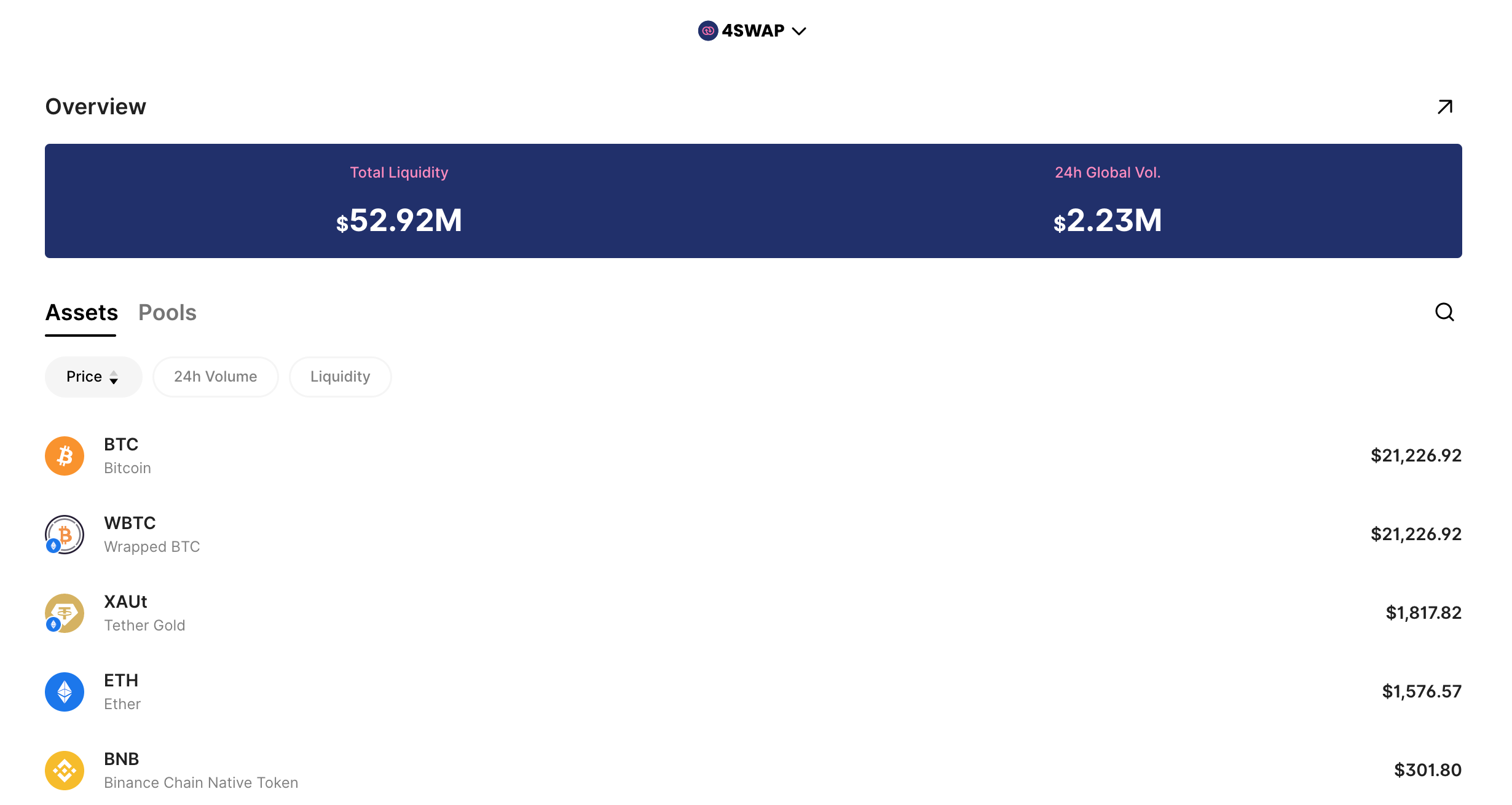

With lightning-fast trades and zero gas fees, Pando Lake is a DeFi protocol that allows for automated liquidity provision. Users can easily swap crypto assets and pairs and become liquidity providers.

Pando Lake and 4swap both employ the basic protocols provided by 4swap, which features a "Broker" mechanism for user interaction. Anyone can join the community at 4swap, which drives the protocol.

Compared to more popular liquidity pools like Aave and 1inch, Pando offers a well secured smart contract that protects users from the potential drain of liquidity pools by hackers. 4swap’s ability to support cross-chain transactions, fast transaction speed, and zero gas fees makes it one of the best in the market. It offers an intuitive and seamless user interface that aids the user experience of swapping and zapping into liquidity pools.

For the pairs pUSD-USDT (ERC-20), pUSD-USDT (TRC-20), pUSD-USDC, pUSD-DAI, and BTC-wBTC, the swapping fee is 0.04%. For the rest of the pairs, the swapping fee is 0.3%.

Each liquidity provider is paid a trading fee based on their proportionate share of the liquidity pool.

The total liquidity on Pando Lake is $21.2 million while that of 4swap stands at $86.8 million.

3. Pando Wave:

Dollar or gold. This means that their prices are stable and not susceptible to the volatility of other types of cryptocurrencies. With Pando Wave, you can earn interest on your stablecoin holdings in a manner similar to an interest-earning savings account.

Pando Wave users can earn interest on crypto assets. Using stablecoins like USDT and USDC, there's a 3.72% annual rate of return on deposits. All you need to do is deposit your stablecoin, sit back, and enjoy your return.

The risk attached to stablecoin interest rates is that, while they may remain within a range, their prices can always fluctuate. This may affect the interest rates you can earn.

Also, cryptocurrency interest rates are not regulated like those of typical banks. Hence, exchanges don't offer insurance for loss, making users vulnerable to hacks and cyberattacks. However, with Pando Wave, users can easily redeem their principal and rewards anytime they want.

Should You Use Pando?

Pando's suites of products are some of the best in the DeFi market. They offer the ordinary crypto investor a variety of products that allow for lending, providing liquidity, and earning interest on deposits.

True to its decentralized origin, Pando's series of products support different wallets. Users can use Metamask, Fennec, and the Mixin messenger for their transactions.

The institution-grade Mixin network helps make Pando an innovator in the market. Seamless transactions and fortified lending and borrowing protocols make the ecosystem an exciting prospect. With Pando, the future of DeFi is in safe hands.

The information contained in this article is for informational purposes only and does not constitute financial, investment, or other professional advice. The views expressed in this article are those of the author and do not necessarily represent the views of the company or organization they work for or Pando. Any investment decisions made by the reader should be made after consulting with their own financial advisor and conducting their own research. The author and the company or organization they work for and Pando will not be liable for any financial losses incurred as a result of reliance on the information contained in this article.