Pando Rings - The Lending and Borrowing Vault

Suppose you want to buy a nice car that's a little bit too expensive for you. What you'll have to do is to get a loan from a bank, and give the bank the right to dispose your car. That way, when you don't pay back, they can take ownership of your car. Or if you are trying to get your first house, you would likely take a mortgage. You put a down payment of 20%, then you can borrow the rest 80%, in which way you will be able to make the payment.

Well, that money for the car and the house comes from a bank. They lend you money knowing you’ll pay high interest on what you have borrowed, and they give that interest to their lenders. Pando Rings is the cryptocurrency version of that bank.

DeFi protocol Pando Rings is one of the most convenient lenders of cryptocurrency. Here is how it works.

What is Pando Rings

Pando Rings is a project of Pando, which serves as the foundation of lending and borrowing digital assets and cryptocurrencies. In short, Pando Rings is a decentralized lending and borrowing platform. Users can earn interest for lending their assets on the platform and must pay interest when borrowing them.

Pando Rings utilizes smart contracts, which are just codes that run automatically when certain conditions are met.

You may visit the Pando network website and locate Pando Rings investment options here.

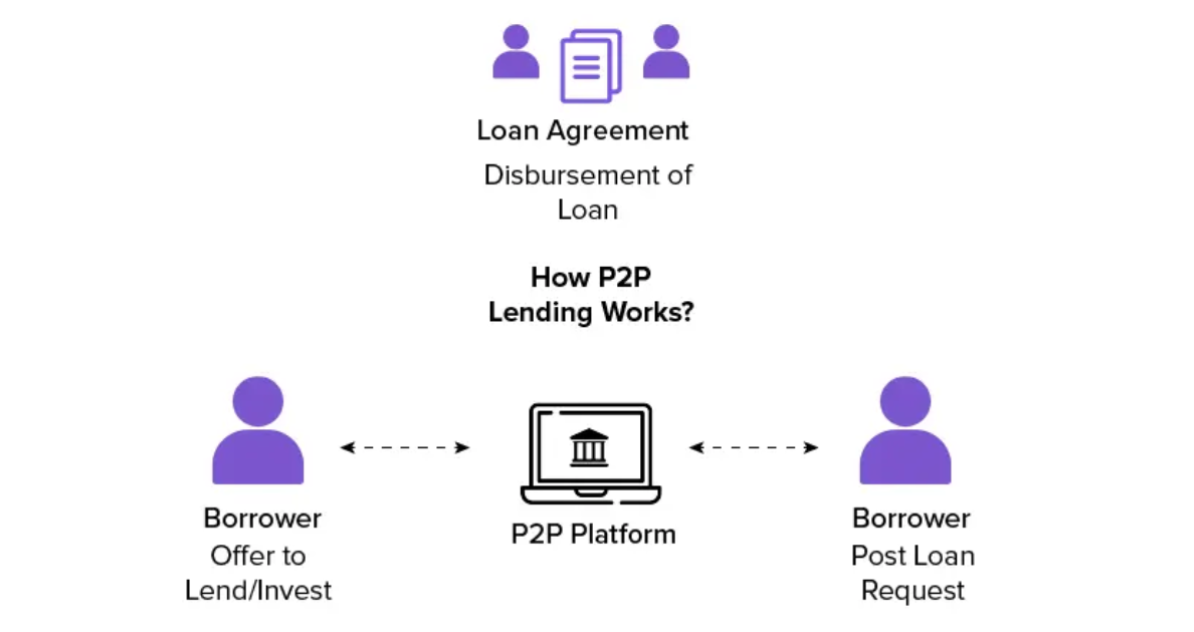

How lending works on in DeFi settings

In the past, you had to visit a bank or other financial institution with a lot of liquid cash in order to apply for a loan. When applying for a loan for a car, the bank will request collateral, which in this case would be the car title itself. The principal and interest are then paid each month to the bank.

DeFi is distinctive. No bank exists. The heavy lifting is instead done by smart contracts (computer instructions that automate transactions, like selling if a token price hits a specific threshold). DeFi eliminates middlemen from the trading of assets, futures agreements, and savings accounts.

In actuality, this entails that you are able to borrow money, in cryptocurrency, from individuals as opposed to banking organizations. The requirement for collateral remains, though. This refers to other cryptocurrencies in a DeFi system that aims to be fiat-free.

A lot of DeFi sites demand overcollateralization because cryptocurrencies are so unstable. As a result, for example, in order to borrow $500 in cryptocurrency on Aave, you would have to deposit a larger sum of another coin. Your collateral may be liquidated, meaning that the protocol takes it to meet the cost of your loan, if the price falls and the amount in it no longer covers the amount you have borrowed.

How lending and borrowing works on Pando Rings

If you go to the Pando Rings page on the Pando network, you can see the current rates for lending and borrowing.

For example you look at the current APY return for lending Tether, you’ll notice it’s offering a decent return.

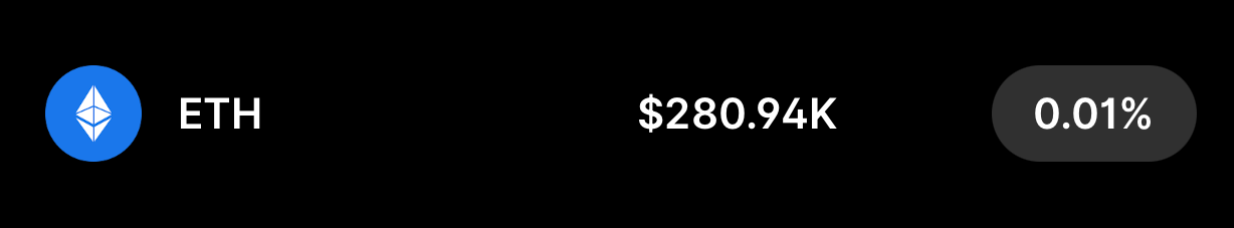

In comparison, APY for lending ETH is pretty low.

So, how this works is, you lend your money to the pando network and they pay you interest on it. The APYs are decided by the supply and demand of the cryptocurrencies on the Rings market. More specifically, the official documenation provides a detailed explanation.

With lending comes borrowing. After lending some of your cryptocurrency assets to the Pando network, you can also go ahead and borrow other cryptocurrencies against them.

Over-collateralized Loans

When you get a morgage against your house, the house is the collateral. This means if you couldn’t pay the money back to the bank, your house will be taken away from you.

Crypto loans don’t work like this, for you to borrow, you need to over-collateralize. This means if you are borrowing $100, you’ll need to pay $120 as collateral. For most people this might sound crazy, “why would I want to drop more money than I need?”.

However, imagine you give me $100 of ETH and in exchange, I give you $80 of Tether, which is a stablecoin pegged to the US dollar. You then use the $80 tether for a few months, and decide to pay back so you can get your ETH. If by then the price of ETH has doubled, you would be cashing out $200 worth of ETH because ETH increased in price. But this is a double-edged sword, if the ETH price drops and your loan exceeds the maximum amount can be borrowed, because pando has a liquidation threshold, you ETH asset will be automatically auctioned to cover the loan you have created.

With the mechanism, lenders don't lose money.

Why would you want to borrow cryptocurrency?

Although buying or selling cryptocurrency is the more frequent use case, borrowing has its value. Arbitrage is one of the most evident. If you see that a token is trading at various prices on various exchanges, you can profit by buying it at one location and selling it at another.

However, you'd need to hold a large sum of the cryptocurrency to make a substantial return because differences are often negligible once transaction costs and spreads are taken into consideration.

A tip: Use the Pando ring to create leverage trading.

- Let’s say you deposit $100 worth of Ethereum as collateral and you borrow $80 worth of Tether which is pegged to the US dollar.

- You take the $80 tether to UNISWAP and trade it out for more Ethereum, which you then take back to Pando and deposit.

- So now you have deposited $180 of Ethereum, but can still take out 80% of the deposited asset which is $64 tether, you can keep trade that on UNISWAP for more ETH and deposit it on Pando.

- Now you have $244 ETH, even if you deposited $100 initially.

- So if ETH goes up 10%, you’ll gain $24, compared to if you have not taken that leverage trade, you would have only gained just $10.

However, unfortunately if the price of Ethereum goes down, all I can say is that “You are screwed” if you pass the liquidation threshold. So you need to be careful with your loan planning.

Paying back Loans

To do this, simply log in to your Pando network account, you can access it by clicking on the borrowed asset card of the borrow section on the Me page.

You can drag on the progress bar to decide on the percentage you want to repay.

The information contained in this article is for informational purposes only and does not constitute financial, investment, or other professional advice. The views expressed in this article are those of the author and do not necessarily represent the views of the company or organization they work for or Pando. Any investment decisions made by the reader should be made after consulting with their own financial advisor and conducting their own research. The author and the company or organization they work for and Pando will not be liable for any financial losses incurred as a result of reliance on the information contained in this article.